Buyers

I absolutely love working with new home buyers! What I love more is providing amazing resources so that each of my clients have the best experience and a smooth transition into purchasing their next home. What's most important is having someone you can trust in assisting you with making what many people describe as one of the biggest decisions of their life. I have prepared some of the basic resources below to help you along the way. I make sure that you are equipped with a Buyer's Guide to give you an idea of what the process looks form beginning to end, a general timeframe and many of the cost involved throughout. Preparing for our consultation is a Buyer Questionnaire with items you'll need to get started.

Each of these items are downloadable. Most buyers have many of the same questions so I've prepared a list of Common Questions for you to review. While you are ready to move forward, check out some calculations of how much house you can purchase and what those costs look like in the Mortgage Calculator. Once you are all set, begin searching for available homes in your preferred areas. Once you have found your new home, be sure to come back and download your Moving Checklist. Let's get searching!

BUYER COMMON QUESTIONS

"WHAT IS THE FIRST STEP IN BUYING A HOME?"

Call me! We will chat about your home buying needs and if you have not spoken with a lender I can suggest some great mortgage lenders that you may begin shopping for an excellent rate and get pre-approved.

"HOW DO I APPLY FOR A MORTGAGE?"

Following identifying your needs through a brief assessment, your lender can provide you with a mortgage loan application and all of the documents you need to gather and submit for your pre-approval.

"HOW MUCH HOME CAN I AFFORD?"

Identifying your ability to purchase your next home evaluates many factors such as income, expenses, length of employment, credit rating, down payment and interest rate. Check out the Mortgage Calculator to help determine how much mortgage you can afford.

"CAN I BUY A HOME WITH BAD CREDIT?"

It can be difficult assessing whether your ability to buy a home is now or later. Speaking with a lender is your best bet in knowing where you are in the process. If not now, they can outline a great plan to get you on the right path.

"HOW MUCH DO I NEED FOR A DOWN PAYMENT?"

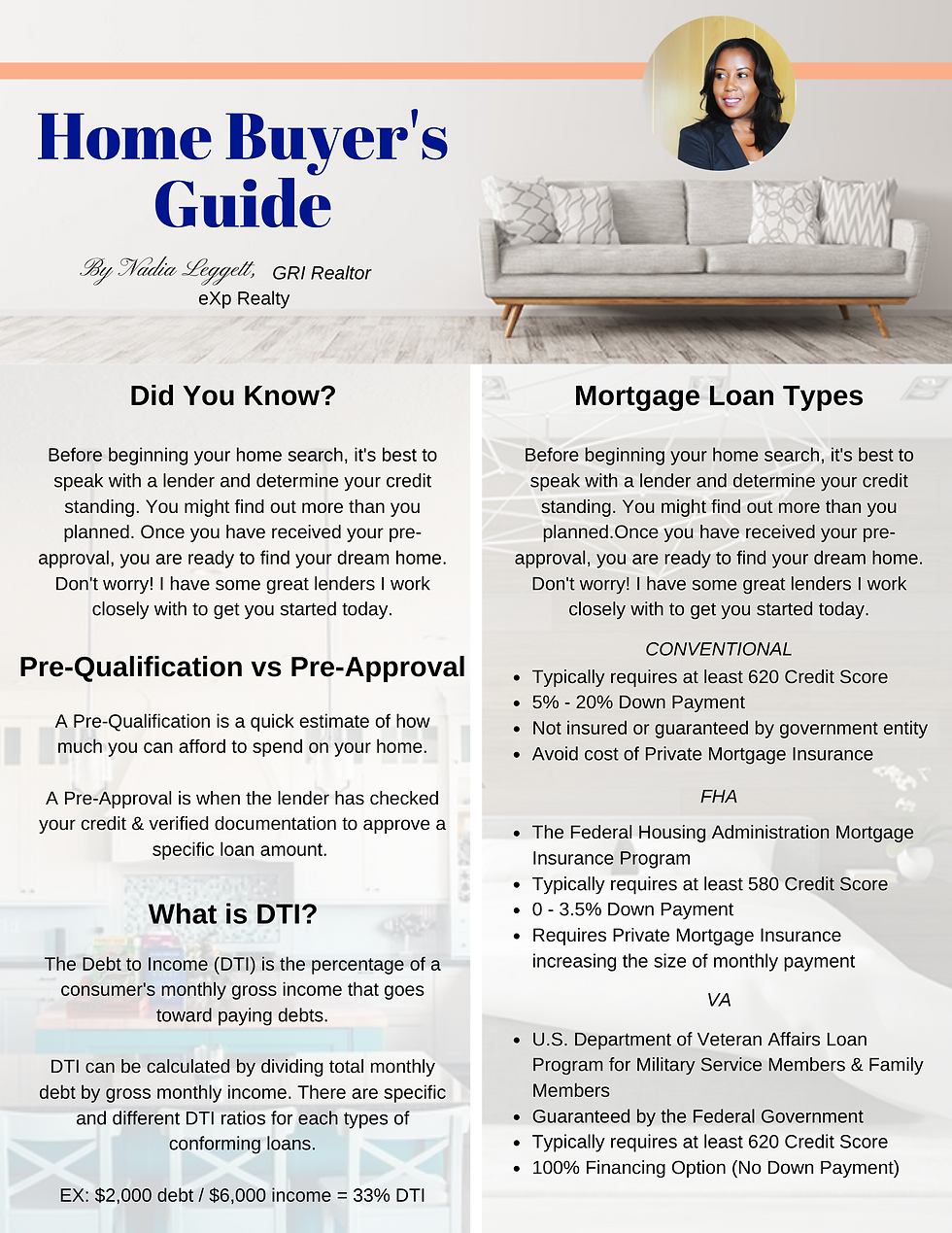

Down payments are typically 3.5% - 5% down and can extend as much as 20% down depending on the loan program you choose.

"WHY DO I NEED A REALTOR?"

Navigating a real estate purchase can be complex. There is no substitute for a licensed and experienced real estate professional. From negotiating on your behalf, managing sensitive documents, time management of critical details outlined within the contract, to all of the questions you discover throughout.

"WHO PAYS REALTOR FEES?"

Typically, sellers pay the buyer's cooperative realtor fees at closing. Occasionally, there are circumstances where buyers must pay any amounts in addition to brokerage fees. I am happy to share instances that affect your upfront expense.

"HOW LONG DOES IT TAKE TO BUY A HOME?"

Most transactions expand 30-45 days depending on the loan type, if 3rd party funding assistance is needed and the cooperation from all parties involved.

"WHAT FEES SHOULD I EXPECT?"

Getting financially prepared for buying your home shall include Loan Origination, Down Payment, Closing Costs, Inspection Costs and sometimes involves Earnest Money. I can help you understand how each plays a role in buying your next home.

"WHICH LOAN TYPE IS BETTER?"

The most common loan types are FHA, Conventional, VA and USDA. Each have advantages benefiting buyers and specified requirements. Your lender will outline details of the loan type best for you.

"WHAT MINIMUM CREDIT SCORE WILL I NEED?"

Lenders are generally looking for credit scores of 620 and above. Some lenders will consider a credit score as low as 580 and usually comes with more requirements of strict nature. Don't worry! If you are not there yet, the lender can also outline how to help you improve your score and get you on the home buying path.

"CAN I BUY A HOME WITH $0 MONEY DOWN?"

There are great programs available to assist buyers with the struggle of coming up with a down payment. I have some great lenders to assist with outlining what is currently available to fit your needs.